- Facebook290

- Total 290

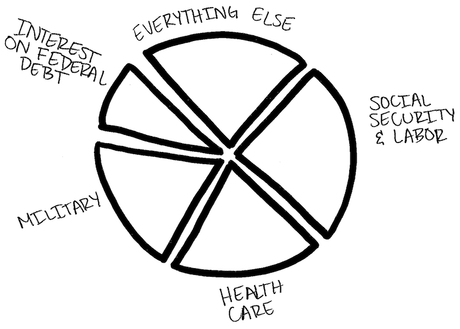

If I had to pick one thing that a citizen of the USA should know, it would be the allocation of money in the federal budget. A simple pie chart is shown below. It’s a static image from the National Priorities Project‘s website, which is rich with interactive graphs and even provides a “Build a Better Budget” simulation. Along with the pie chart, another critical graph shows the basic historical trends over recent decades.

The NPP is helping with public education, but the problem is serious. Right after the election, we asked almost 4,500 young adults, “Does the government spend more on Social Security or foreign aid?” The right answer is Social Security (by a ratio of about 26:1, if we define “aid” as economic assistance, or about 20:1, if we include military assistance). A majority (51.3%) of the young adults chose the wrong answer–foreign aid–and just 29% got the question right.

This is not a youth problem only. In 2011, CNN and the Opinion Research Corporation asked adults how much of the budget the federal government allocates to various programs. The median estimate was 20% for Social Security (which is close to the correct proportion), but 10% for foreign aid (which is far too high).

It’s hard to have a debate about what should happen if people don’t understand what is happening. We don’t teach this kind of material in schools, the mass media don’t explain it regularly or helpfully, and politicians have incentives to obfuscate.