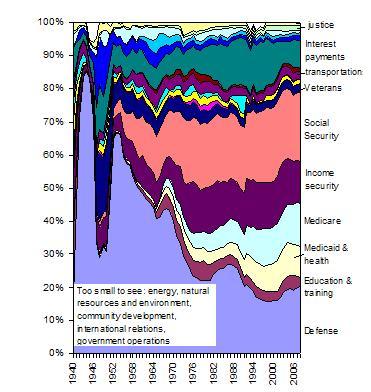

On the day after the president released his 2008 budget, it might be helpful to take a longer view. Below I show the percentage of the total budget (also known as “your tax dollar”) that is devoted to each major category of federal spending. I’ve set the total for every year to 100%, but of course the actual size of the budget has grown enormously. The last year (2008) is the president’s proposal, which will not be implemented as he wishes. On the other hand, his proposal will not be changed enough to make a visible difference on a graph at this scale.

The graph is helpful in making a few points that I don’t think most citizens realize. First, you cannot cut spending appreciably without touching defense, Social Security, Medicare, and Medicaid. (Interest payments are automatic.) Second, Medicare and defense are the two items that have expanded rapidly of late. Third, some categories that provoke opposition, such as foreign aid and grants to artists and scholars, are far too small even to be illustrated. Finally, despite all the storm and stress over important details, both of our major parties are basically committed to the same kind of budget.

Your defense number looks way off, both in level and recent growth. Remember that much of the Iraq and Afghanistan war spending has been funded by supplementals and is left out of the “official” defense spending number. Just straight-up military spending is now over $700 billion annually, as opposed to the official budget number of $480 billion. The $700 billion figure does not include significant additional defense-related spending in departments outside of the Pentagon. For background:

http://www.latimes.com/news/opinion/commentary/la-oe-derugy10feb10,0,5657155.story?coll=la-news-comment-opinions

There was a conventional “centrist” wisdom in the mid to late 90s that there was a budget problem on the Democratic side (entitlements) and a budget problem on the Republican side (defense, taxation), and the two were of equal significance. The Bush tax cuts and a doubling in correctly measured military spending since 2000 have rendered that conventional wisdom obsolete IMO.

The only issue left on the entitlement side is medical costs. If we could cut the military budget back to inflation-adjusted 2000 levels, repeal the Bush tax cuts, and get medical cost growth down to, say, inflation + 2%, we could easily afford all our national committments, while still maintaining the lowest overall tax rate of any major industrialized country.

The figure I show for defense in 2008 is $606 billion, up from $572 billion in 2007. The LA Times’ estimate of $700 billion is significantly higher. (One hundred billion here, one hundred billion there, and pretty soon you’re talking real money.) However, as a percentage of the federal budget, the LA Times’ estimate is about 23%–not hugely bigger than the fraction I show on my graph. (I also show $83 billion for Veterans benefits separately.)