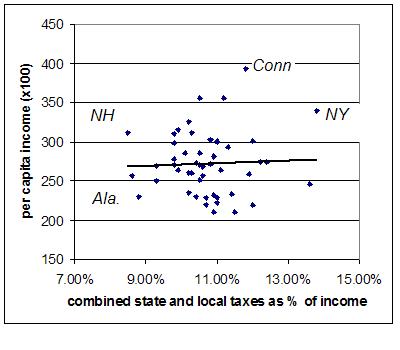

I was wondering whether the states that tax their residents

at high rates tend to have higher or lower income levels. I

suppose a crude form of free-market economics would predict that states

with lower taxes would tend to generate more personal income. This is

not the case. Although the relationship between tax rates and per capita

income is not significant, generally the states that take the biggest

portion of income in state and local taxes also have the most per

capita wealth. States like Alabama have been low-tax zones for at least

a hundred years, yet they remain among the poorest of all states.

This isn’t "social science." It’s just playing with a computer

to get a quick answer to a simplistic question. Still, the graph poses

a real question for supporters of laissez-faire economics: if low taxes

create wealth, what explains Alabama? (Sources for the tax

rates and the per

capita income stats.)

Look at the growth in wealth over the past 50 years. Fifty years ago, most of the states had low state and local tax burden. The wealth differentials, however, were already established.