- Facebook51

- Twitter6

- Total 57

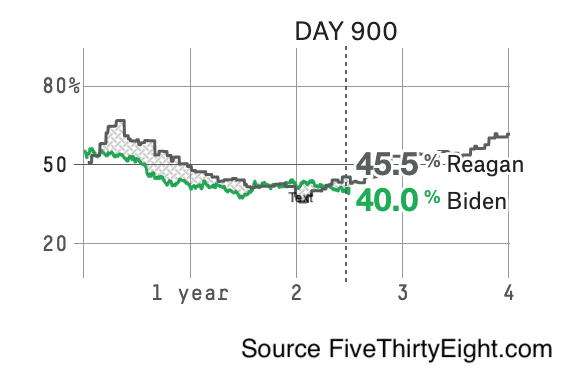

The Biden team is preparing for a Reagan-style victory lap in the event that the economy looks healthy in 2024. I hope they are also prepping for more difficult circumstances, since the economic forecast is highly uncertain. However, for what it’s worth, Morgan Stanley “now projects 1.9% GDP growth for the first half of this year.”

These are my prior assumptions:

- A president has limited and ambiguous impact on macroeconomic trends. Too many other factors matter, from the Federal Reserve and Congress to the business cycle, and from wars and technological developments to the budgets of 50 states.

- Although many people vote on other grounds, enough marginal voters are influenced by recent changes in the economy that those trends predict the results of presidential elections.

- People cite the economic and electoral fortunes of each presidential administration to support their ideological positions. For instance, the apparent successes of FDR and Reagan were used to vindicate New Deal liberalism and neoliberalism, respectively.

- Economic trends influence public opinion, but they do not determine the outcome of the debate about ideology. Eisenhower, Clinton, and Obama are examples of presidents who saw healthy net economic growth and were reelected, yet their administrations did not move public opinion as FDR’s and Reagan’s did. The big shifts in opinion seem to reflect changes in the Zeitgeist, not just electoral and economic developments.

Applying #1 means that Biden’s policies will not affect the economy much in 2024, even though Morgan Stanley believes that he is responsible for the upturn. According to #2, Biden will win pretty easily if growth is robust but could lose to Trump or another Republican if it stalls.

Per #3, if the economy grows and Biden wins, the President and many Democrats will argue that the reason was his industrial policy, which is aggressive, green, and pro-equity. I favor the policy, so I will be hoping that this argument sticks, even though I believe that macroeconomic trends are out of his hands.

If the case for Bidenomics does persuade, it will be thanks to the Zeitgeist. To make that explanation a little less mystical, I would focus on two factors.

First, the previously dominant neoliberal view really is fading now, much as late-Victorian laissez-faire was faltering by 1932 and New Deal liberalism had run its course by 1980. By a certain point, established theories don’t offer plausible solutions to the problems of the day, but alternatives do. By the time FDR took office, his home state of New York and several others had already moved in the direction of the New Deal; Roosevelt took the opportunity to bring their ideas to Washington. Likewise for Reagan in 1980–and for Biden in 2020. Indeed, Trump is no neoliberal, and there will probably be no national candidate who runs on cutting taxes and spending.

Second, the demographic basis of politics has shifted. I avoid crude materialistic and class-based predictions, yet the people who have the most to gain from low taxes and light regulation are business owners and investors. They are now outweighed in the GOP (which they once controlled) by working-class voters. They are represented in the Democratic Party, but outweighed there, too, by diverse lower-income voters, public sector workers, and salaried professionals.

The tectonic plates are shifting, and it’s at such moments that presidential administrations become examples or even metaphors for fundamental change. We had a “new deal for America” and then saw “morning in America” once the actual New Deal state faltered. The opportunity to make another such shift is a good reason to run a celebratory campaign in 2024–if (but only if) the economy holds up.

See also: federal spending for both climate and democracy